How Investors Evaluate Companies’ ESG Performance: Understanding the Criteria

As sustainability increasingly shapes market dynamics, investors are placing growing emphasis on a company’s performance in environmental, social, and governance areas. ESG evaluation has moved from being a peripheral concern to a core element in risk management and long‑term value creation. With more standardized frameworks and abundant data now available, investors can systematically assess nonfinancial performance to make informed decisions that align profitability with positive social impact.

The Pillars of ESG Evaluation

Investors typically break down ESG performance into three interrelated pillars—Environmental, Social, and Governance—each with its own set of measurable criteria.

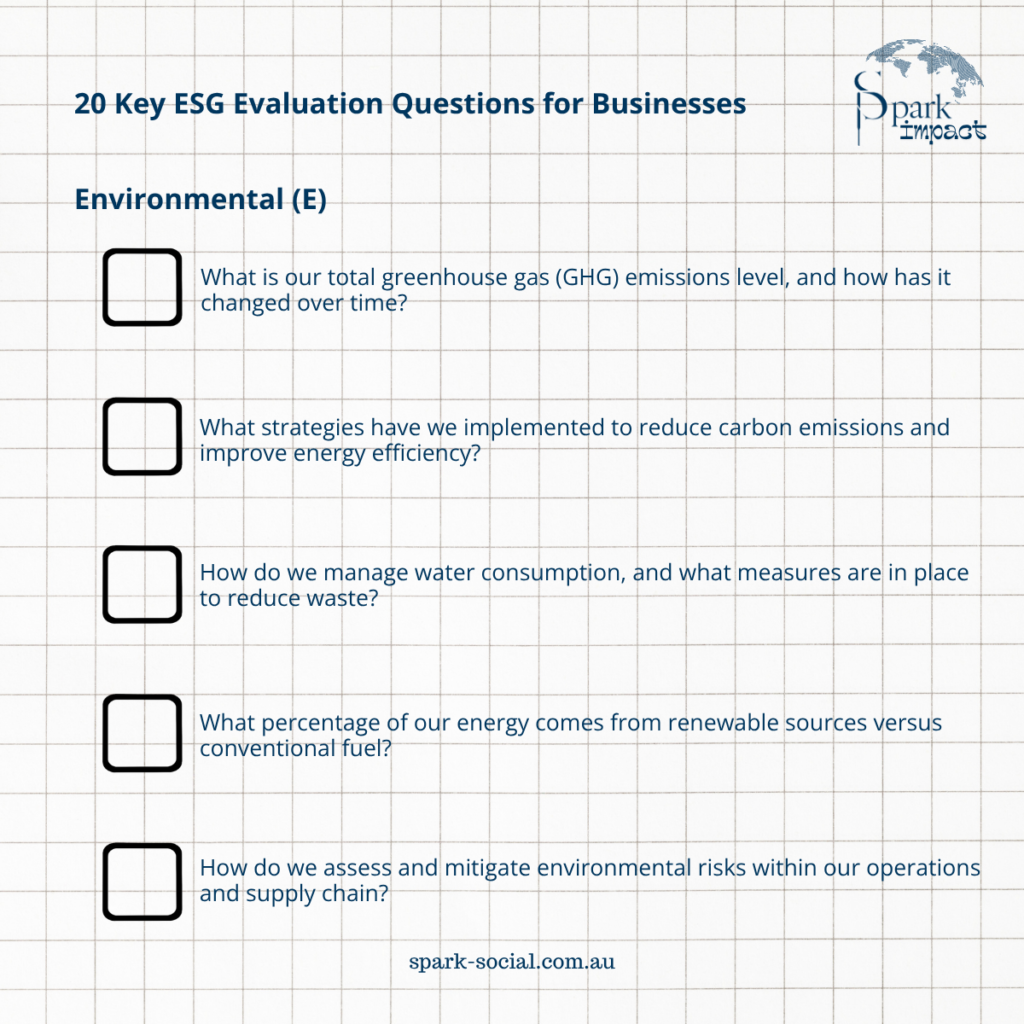

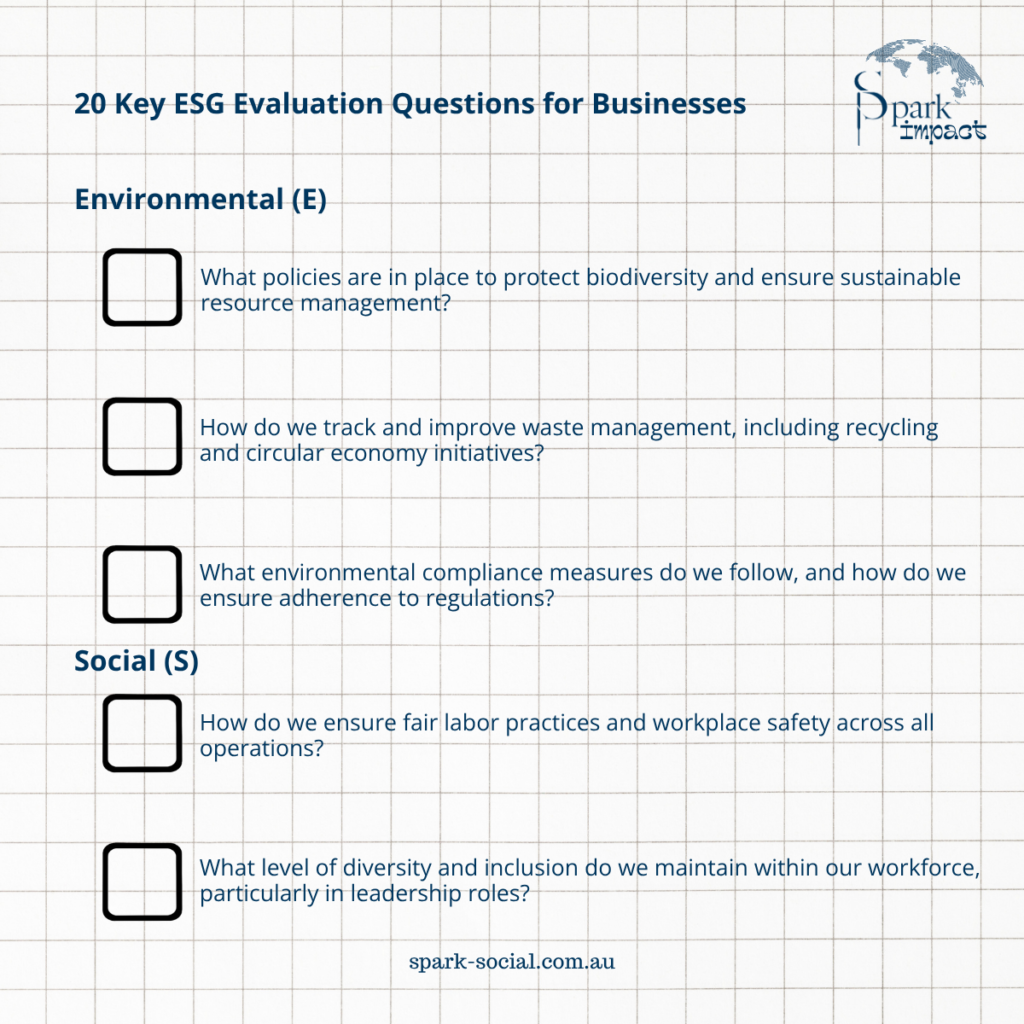

Environmental Criteria focus on a company’s impact on the natural world and include metrics such as:

- Carbon Emissions and Energy Efficiency: Evaluating greenhouse gas emissions intensity and the progress toward achieving net‑zero targets. Companies are increasingly measured on their emission reduction strategies, which have direct implications on regulatory risk and long‑term operational costs.

- Resource Management and Waste Reduction: Assessing water usage, waste management practices, and circular economy initiatives. For instance, companies with robust recycling programs and efficient resource usage are considered more resilient in the face of resource scarcity.

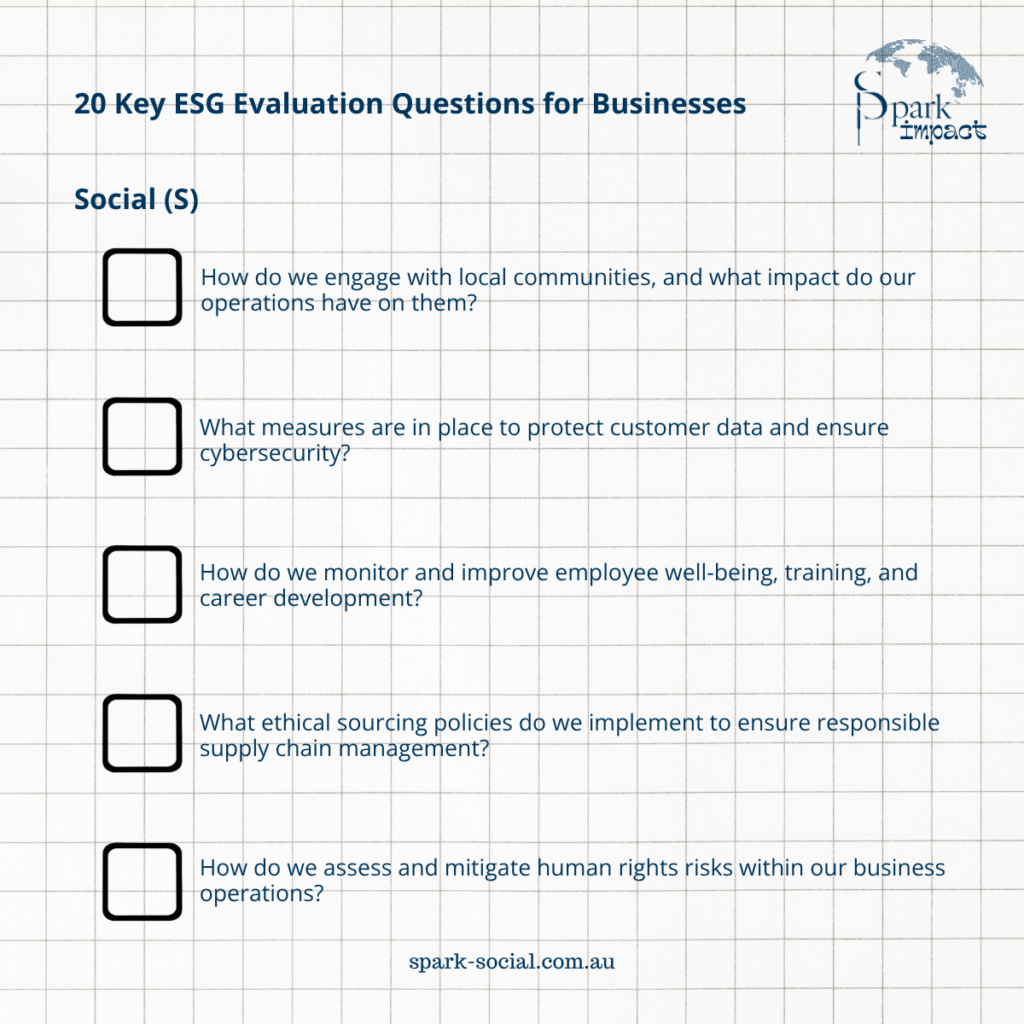

Social Criteria assess how a company manages relationships with its employees, customers, suppliers, and communities. Key factors include:

- Workforce Diversity and Inclusion: Measuring gender, ethnic, and age diversity within the organization, as well as policies promoting equal opportunity.

- Labor Standards and Community Engagement: Evaluating workplace safety, fair labor practices, and contributions to local communities. Transparent reporting on these facets helps investors discern a company’s social impact and operational integrity.

- Data Privacy and Customer Protection: Ensuring robust cybersecurity measures and ethical handling of personal data, which are increasingly critical in today’s digital economy.

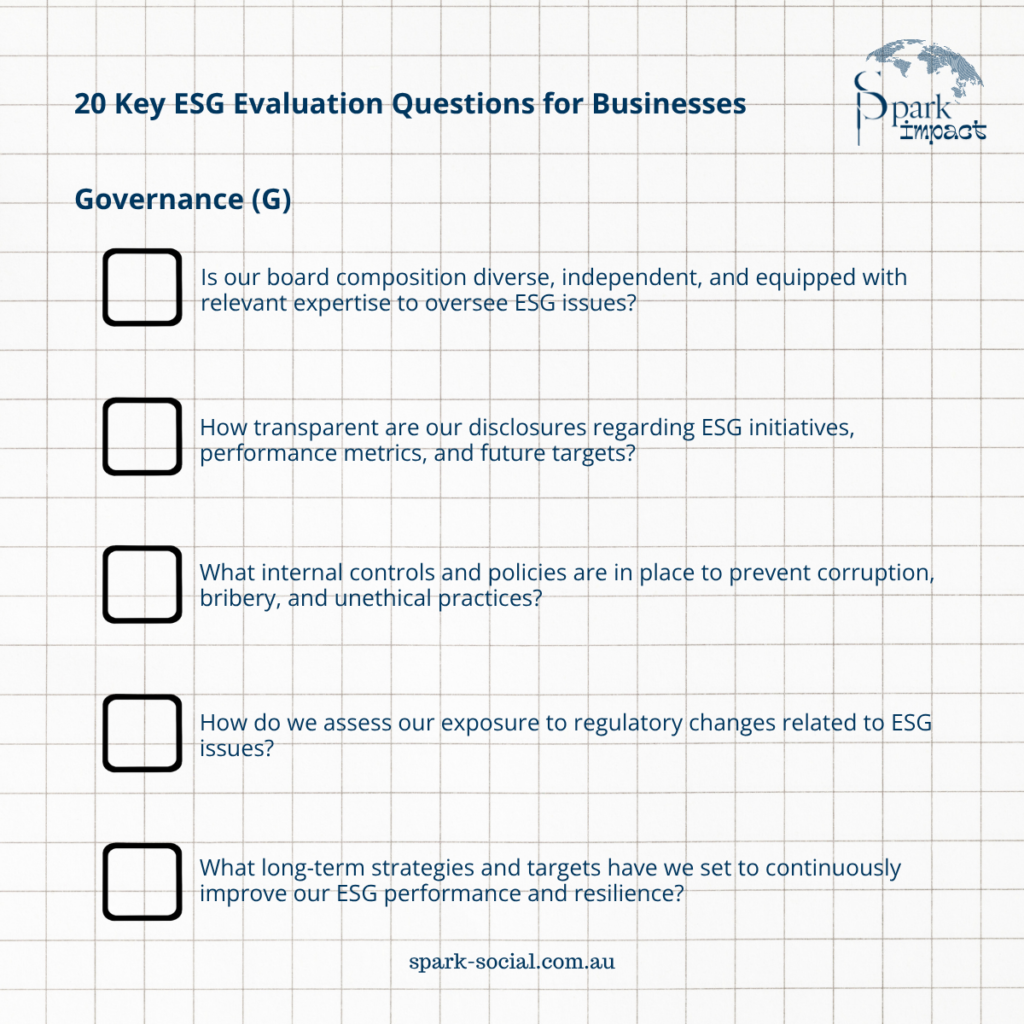

Governance Criteria examine the structures and processes in place to steer company behavior and ensure accountability. Important aspects include:

- Board Composition and Executive Remuneration: Assessing the diversity, independence, and expertise of board members, along with transparent and performance‐aligned compensation policies.

- Transparency and Ethical Conduct: Evaluating policies and practices designed to prevent corruption, fraud, and conflicts of interest, which collectively influence investor confidence.

- Risk Management and Regulatory Compliance: Reviewing how effectively a company anticipates and mitigates emerging risks in its operations and strategic decisions.

ESG Rating Systems and Evaluation Methodologies

Investors utilize a range of rating systems to compare companies against these criteria. Leading agencies such as MSCI, Sustainalytics, and S&P Global have developed proprietary methodologies that assign quantitative scores based on a company’s performance across the three ESG pillars. For example, Sustainalytics employs over 250 indicators, distilled into 20 material questions, to determine ESG risk ratings. These ratings help investors identify companies that demonstrate robust sustainability practices while simultaneously reducing portfolio volatility.

In addition to third‑party ratings, many investors supplement these frameworks with alternative data—such as satellite imagery for environmental monitoring, supply chain analytics, and social sentiment metrics—to obtain a more holistic view. This combined approach helps investors sift through disparate data sources and adjust for potential biases, such as greenwashing, ensuring more accurate comparisons across industries.

A survey conducted by PwC in December 2023 found that 69% of fund managers consider ESG criteria essential for creating long‑term value in their investment strategies. This growing acceptance highlights the increasing reliance on standardized metrics and quantitative models that integrate ESG performance alongside traditional financial indicators.

Applying Data‑Driven Strategies for Robust ESG Assessment

By harnessing big data and machine learning techniques, investors can now develop predictive models that integrate ESG scores with conventional risk metrics. Interactive dashboards and tailored visualization tools allow real‑time tracking of key ESG performance indicators, enabling investors to identify trends, anticipate risks, and make dynamic portfolio adjustments. These data‑driven approaches not only enhance decision‑making but also promote transparency, as clear, objective metrics make it possible to benchmark relative performance within and across industries.

Quantitative benchmarking remains a critical tool. Investors often compare ESG performance against industry peers and external benchmarks, which helps to distinguish true sustainability leaders from companies that may only superficially align with ESG principles. This methodical approach ensures that capital is allocated to companies that are not only financially robust but are also proactive in managing environmental risks, social challenges, and governance responsibilities.

Challenges and the Path Ahead

Despite the advancements, challenges persist. The absence of a universally accepted ESG reporting framework means that discrepancies still exist in data quality and comparability across different rating systems. Inconsistent reporting standards and potential greenwashing can obscure a company’s true performance, necessitating a rigorous, multi‑source verification process. Nonetheless, ongoing initiatives by the International Sustainability Standards Board (ISSB) and other regulatory bodies aim to harmonize ESG metrics in the near future, promising greater clarity and consistency for investors.

Conclusion

Evaluating companies’ ESG performance through well-defined criteria is vital for ensuring sound investment decisions that support long‑term financial and societal value. By focusing on detailed environmental, social, and governance metrics, and by leveraging data‑driven strategies to integrate these factors with traditional financial analysis, investors are better equipped to manage risks and harness opportunities. As the landscape of ESG reporting continues to evolve toward greater standardization and transparency, a disciplined, data-centric approach will be key to driving both competitive returns and meaningful impact.

Sources

- KnowESG. “What Is ESG Performance And How To Measure It?” Retrieved from KnowESG

- PwC Canada. “How to measure your ESG performance.” Retrieved from PwC Canada

- Corporate Finance Institute. “ESG Score – Definition, Process, Implications & Purpose.” Retrieved from CFI

You may also like