How Investment Institutions Drive ESG Transformation: A Data-Driven Perspective on Institutional Commitment and Trends

In recent years, institutional investors have become powerful engines of change by integrating environmental, social, and governance (ESG) principles into their investment decisions. This transformation is not only reshaping capital allocation but also driving a global shift toward sustainability. With growing evidence that companies embracing robust ESG practices tend to outperform their peers, many of the world’s largest investors are now placing a higher premium on sustainable investments, effectively intertwining financial performance with social and environmental responsibility.

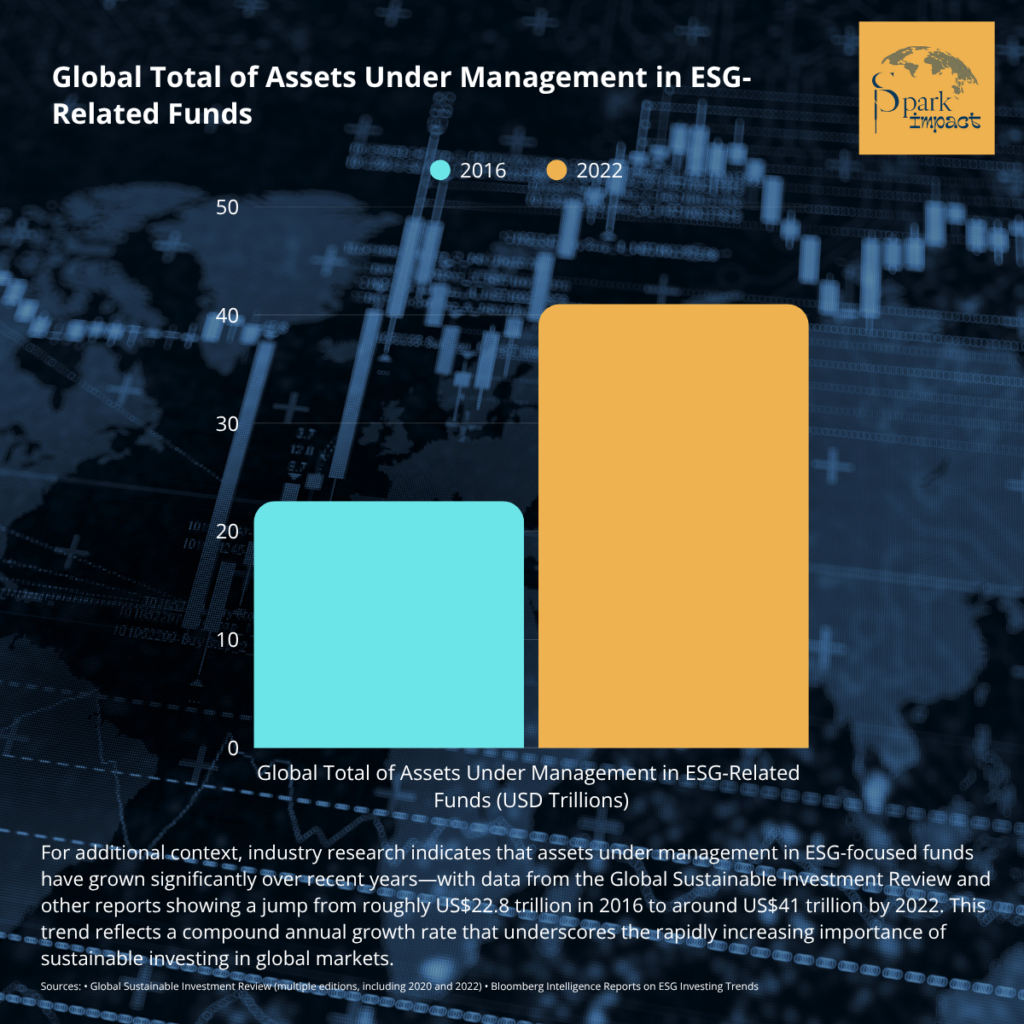

The magnitude of this shift is underscored by the sheer volume of assets now committed to ESG strategies. For instance, Bloomberg Intelligence notes that the global total of assets under management in ESG-related funds has surged from approximately US$22.8 trillion in 2016 to around US$41 trillion in 2022, with projections suggesting that ESG investments will exceed US$50 trillion by 2025. This rapid growth—a compound annual growth rate that underscores the shifting investor focus—is a clear indicator that sustainability is no longer a niche preference but a mainstream mandate. Such figures reflect how institutional investors, including major asset managers like BlackRock, Vanguard, and State Street, are increasingly integrating ESG factors into their decision-making processes.

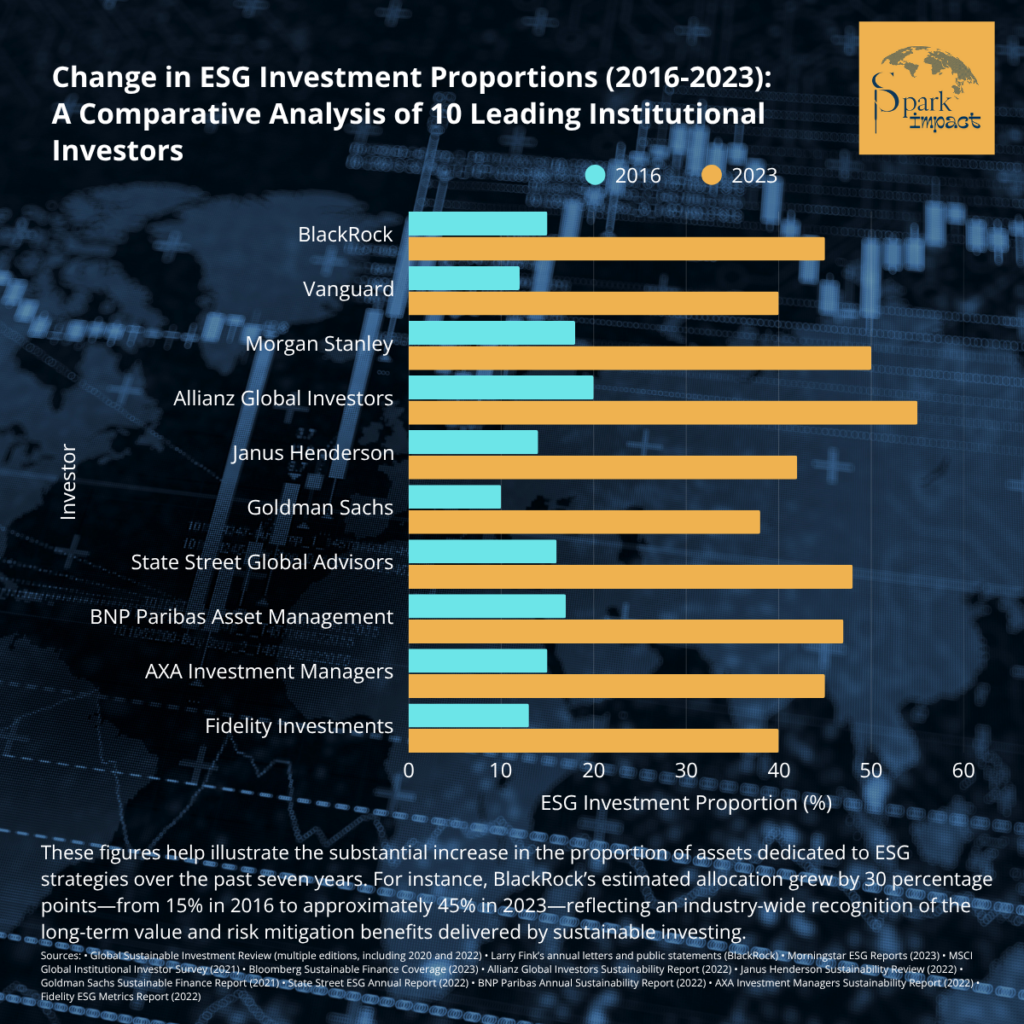

Year-over-year comparisons shed further light on this transformative trend. Data from a comprehensive report by the Global Sustainable Investment Review reveals that institutional assets dedicated to ESG strategies across major markets have not only grown in absolute terms but also as a percentage of total assets. For example, institutional investors in Europe, underpinned by rigorous regulatory frameworks like the EU Sustainable Finance Disclosure Regulation (SFDR) and the Corporate Sustainability Reporting Directive (CSRD), have seen their sustainable asset allocations climb from around 35% of total assets in 2016 to nearly 50% by 2022. In the United States, similar trends are emerging—even as regulators like the Securities and Exchange Commission work to refine ESG disclosure requirements—reflecting an increasing appetite for investments that promise long-term value and risk mitigation. According to data from Morningstar, sustainable funds in North America recorded significant net capital inflows in 2023 despite global economic uncertainties, further affirming that the trend toward ESG investing is robust and enduring.

Institutional investors’ ability to influence corporate behavior is equally critical. Their engagement ranges from active proxy voting to direct dialogues with company boards, all of which help ensure that ESG commitments are not merely superficial but embedded in business strategy. Studies indicate that companies with high institutional ownership in ESG-integrated portfolios experience improved transparency and a heightened focus on long-term risk management. Such investors contend that robust ESG practices enhance operational resilience and reduce costs—benefits that ultimately translate into better financial performance. A study by García-Sánchez et al. (2022) spanning thousands of listed companies between 2009 and 2023 found that sustained institutional ownership in ESG-focused companies was linked to reduced instances of ESG decoupling, reinforcing the notion that effective sustainability practices can yield measurable financial returns.

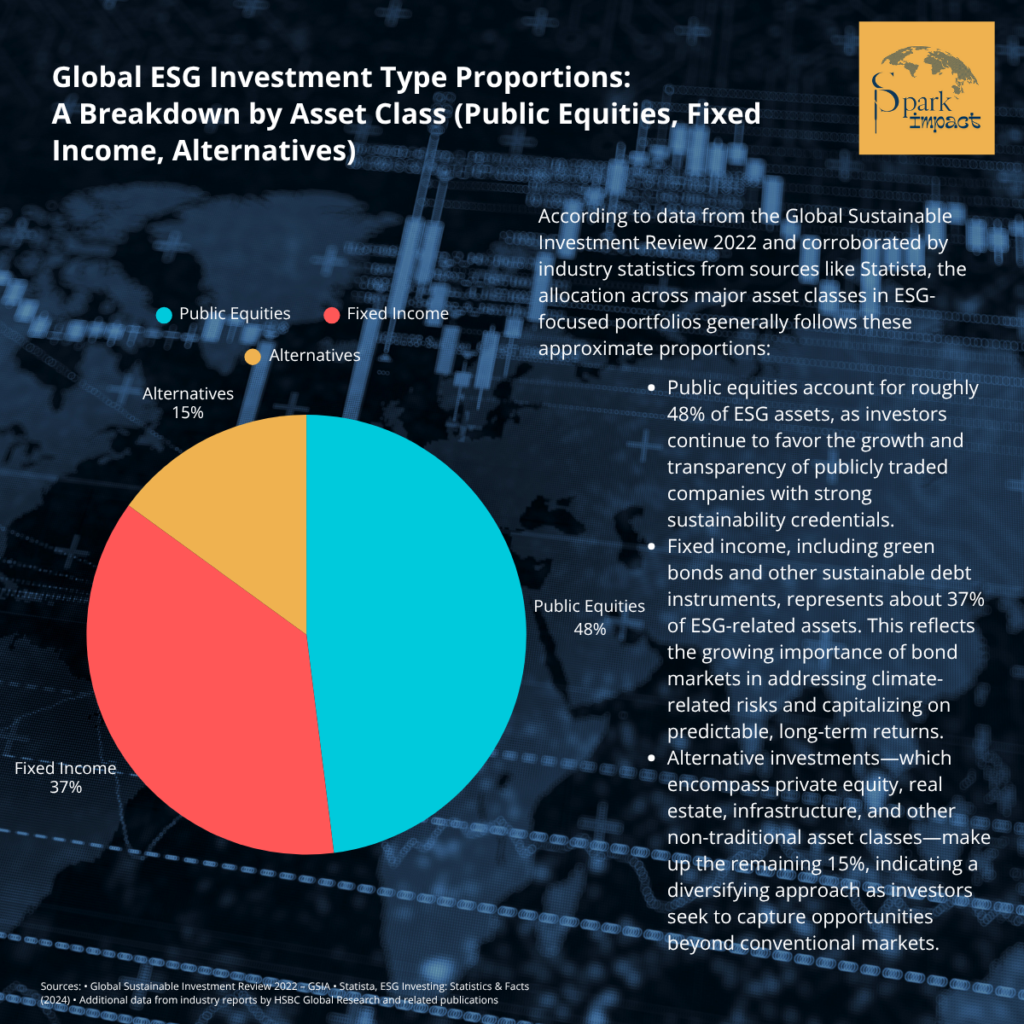

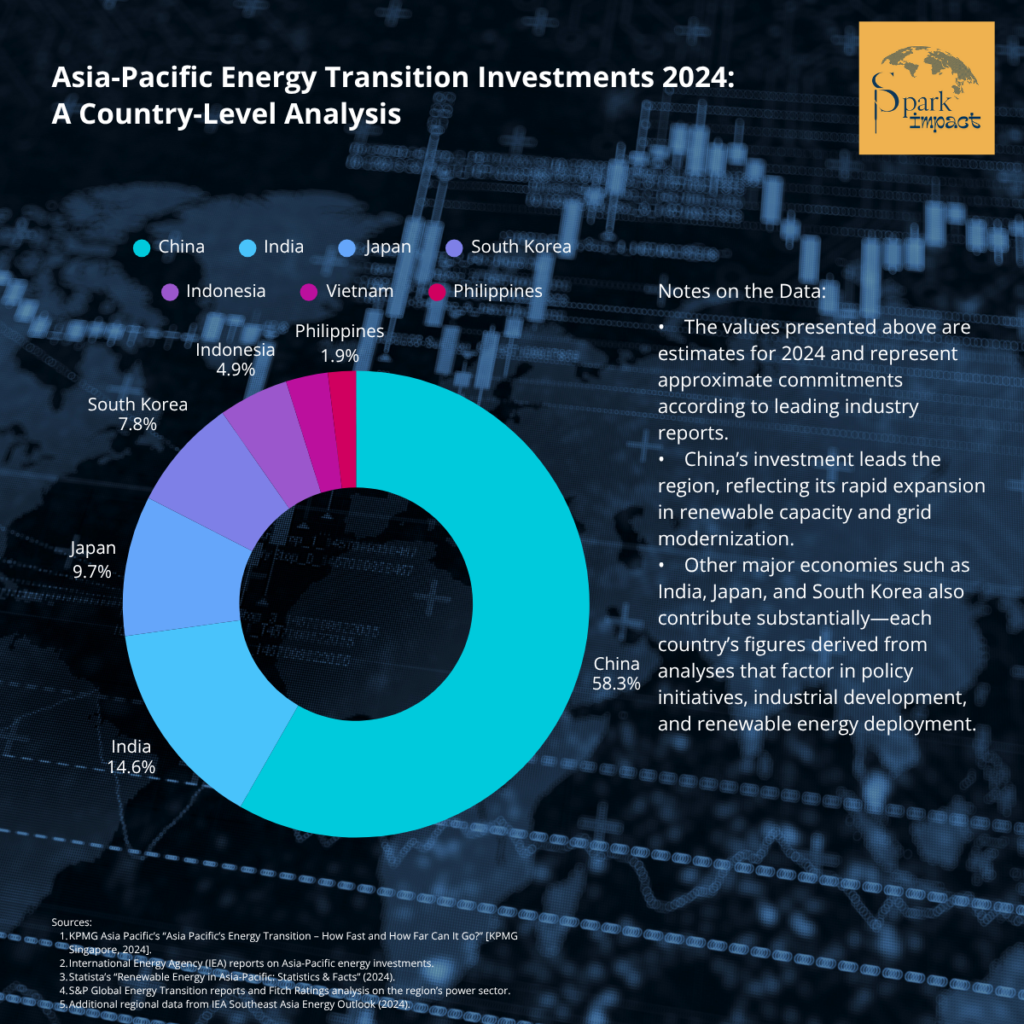

Beyond traditional equity investments, institutional investors are increasingly turning to diverse sustainable financial instruments such as green bonds, ESG exchange-traded funds (ETFs), and sustainability-linked bonds (SLBs). These instruments provide a direct channel for capital to flow into projects that reduce carbon emissions, promote renewable energy, and enhance resource efficiency. According to a report by Grand View Research, the global ESG investing market was valued at approximately US$25.10 trillion in 2023 and is projected to reach US$79.71 trillion by 2030, reflecting the growing commitment of institutional investors to sustainable finance. This expansion is particularly pronounced in regions like the Asia-Pacific, where rapid industrialization and strong governmental support have spurred investments in energy transition initiatives that surpassed US$1 trillion in 2024 alone—a stark contrast to earlier years.

In summary, the data paints a compelling picture: institutional investors are not only directing vast sums toward ESG investments but are also redefining the parameters of successful investing. As firms increasingly adopt sustainable practices under the watchful eye of these influential investors, the cycle of value creation and risk mitigation becomes self-reinforcing. Financial returns and social impact are no longer mutually exclusive; they are intertwined elements that are driving the evolution of global capital markets.

Sources:

- Moody’s. “Outlook: ESG and Sustainable Finance 2025.”

- S&P Global Ratings. “Sustainable Bond Outlook: Global Issuance to Reach US$1 Trillion.”

- Investing in the Web. “ESG Investing Statistics, Data & Trends (2025).”

- Grand View Research. “ESG Investing Market Size, Share & Trends – Forecast to 2030.”

- García-Sánchez, I.-M., et al. (2022).

- “Global Sustainable Fund Flows: Q2 2023 in Review.”

You may also like