From ESG Polarization to Total Value: A New Model for Sustainable Finance

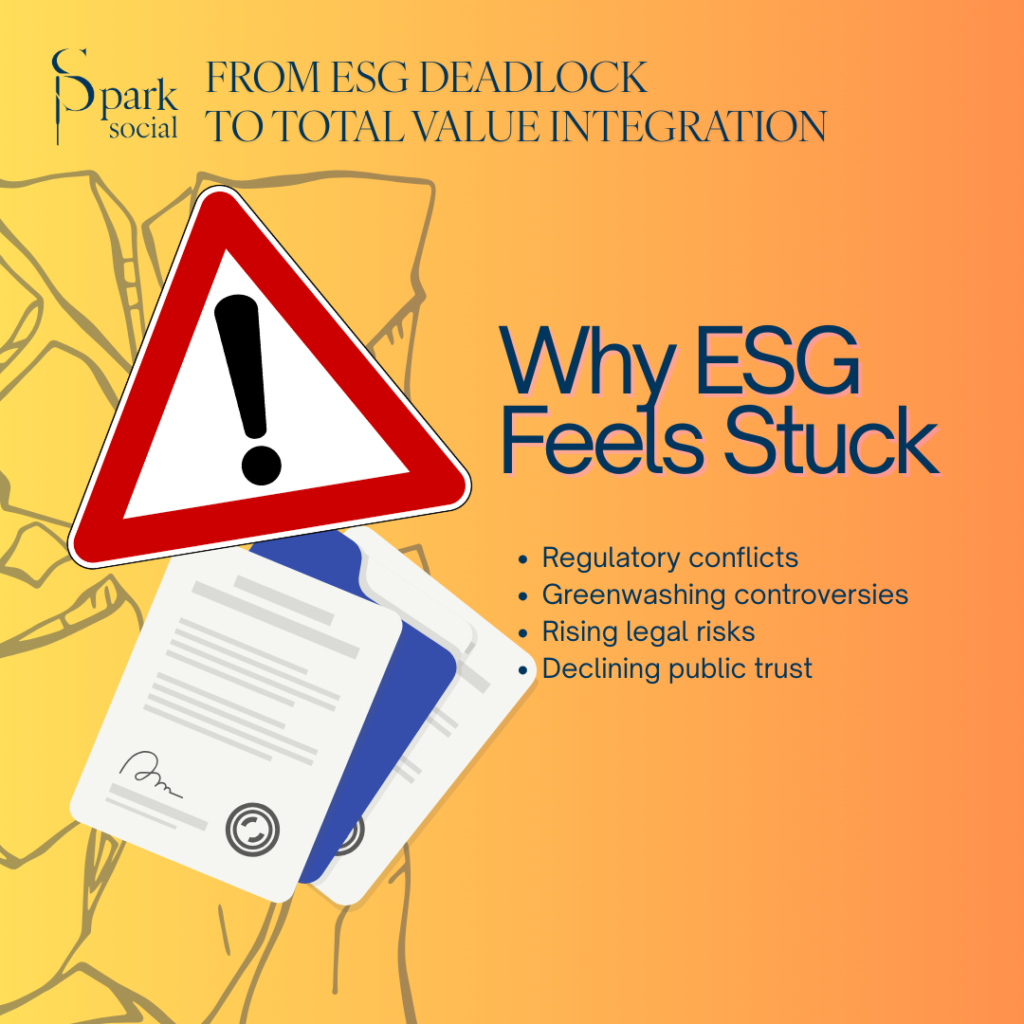

The ESG Stalemate

Over the past two decades, Environmental, Social, and Governance (ESG) considerations have moved from voluntary best practice to mandatory disclosure and regulatory requirements. Initially embraced as a framework for integrating sustainability into financial decision-making, ESG has now become highly politicized. In the States, diverging state-level laws, conflicting federal guidance, and increased legal risks have forced many financial institutions to retreat from public ESG commitments.

This fracturing has left financial institutions (and other companies) navigating a minefield:

- Legal contradictions between jurisdictions

- Reputational risk from both “greenwashing” and “greenhushing” accusations

- Operational uncertainty around compliance standards

- Stakeholder distrust over perceived political alignment

The challenge is clear: the ESG debate is no longer about whether sustainability matters, but how it can be pursued in a way that aligns with fiduciary duties, legal compliance, and long-term value creation.

Why ESG Became a Problem in Its Current Form

The ESG framework, while well-intentioned, suffers from three structural weaknesses:

- Perception as an external agenda — ESG is often seen as a political or ideological program imposed from outside, rather than an intrinsic business imperative.

- Fragmented metrics — Varying standards across jurisdictions make it difficult to prove that ESG actions are directly linked to business performance.

- Misalignment with fiduciary language — ESG goals are often expressed in societal or moral terms rather than in terms of shareholder, client, and portfolio value creation.

These weaknesses have created a trust gap — one that invites legal challenges and political pushback.

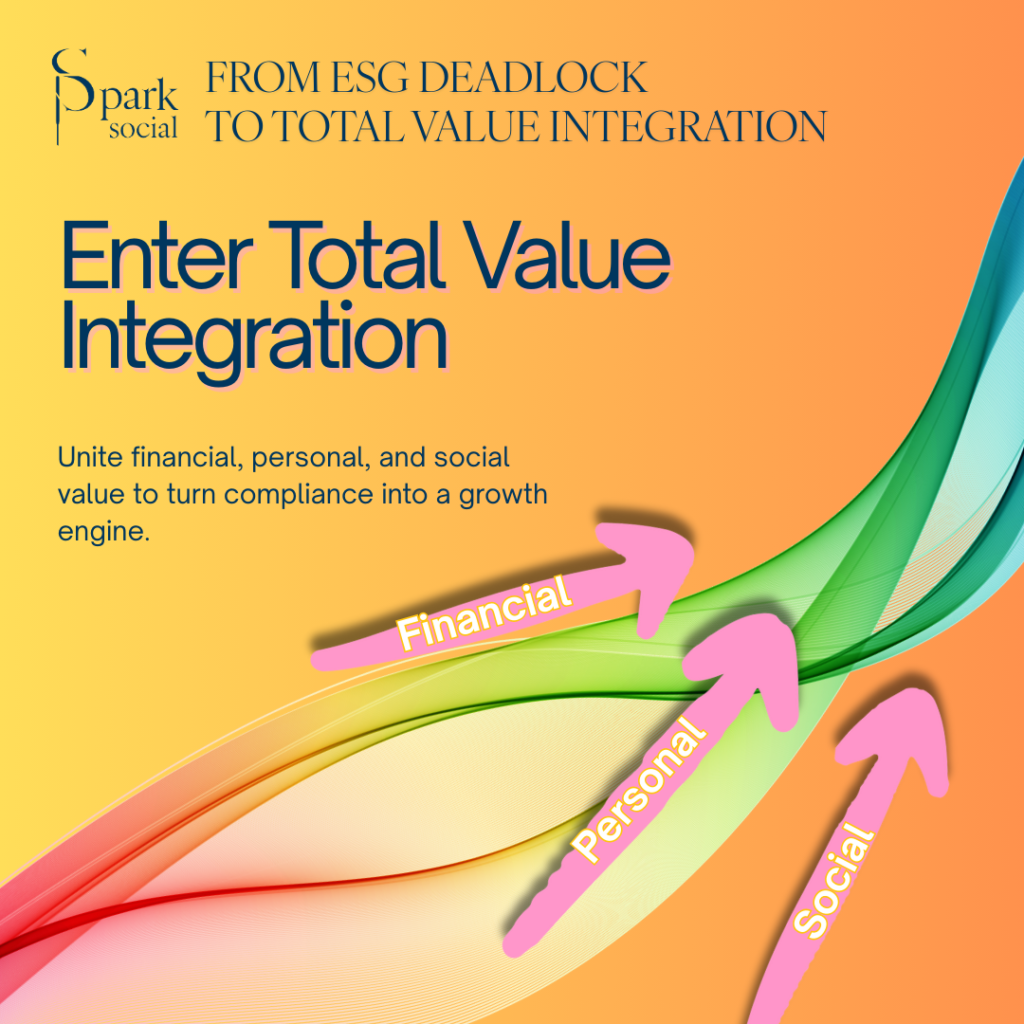

The Spark Social Total Value Model: Reframing the Debate

Spark Social’s Total Value model provides a framework to transcend the ESG stalemate by integrating financial, personal, and social value into a single, measurable proposition. Instead of ESG being perceived as an add-on or political filter, Total Value reframes it as the foundation of long-term business viability.

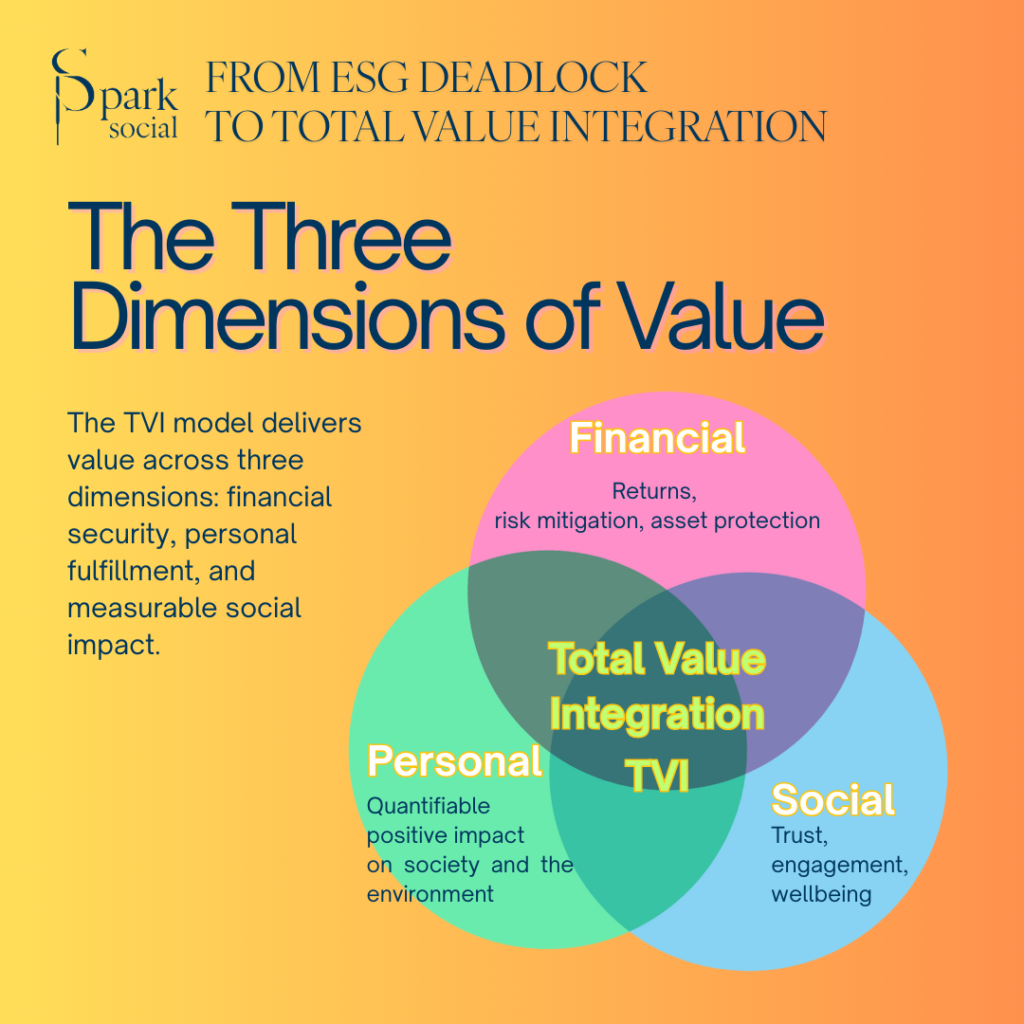

Core Principle: Every decision can — and should — be evaluated through its contribution to:

- Financial Value — measurable return on capital, revenue resilience, and risk-adjusted performance

- Personal Value — wellbeing, trust, and engagement of stakeholders (employees, customers, communities)

- Social Value — positive impact on society and environment, translated into clear, reportable metrics

By defining sustainability not as a political stance but as a business resilience and growth driver, Total Value creates common ground between pro- and anti-ESG stakeholders.

Applying the Total Value Model to ESG Challenges

Legal Compliance Through Value Alignment

Instead of positioning sustainability actions as “non-pecuniary,” Total Value embeds them in ordinary business purpose language. For example:

- Climate risk analysis becomes asset protection and operational continuity planning.

- Diversity initiatives become talent retention and productivity strategies.

- Resource efficiency becomes cost optimization.

This framing satisfies state “pecuniary interest” laws while maintaining alignment with global ESG expectations.

Mitigating Political and Reputational Risk

- From ESG labels to business outcomes: Avoid politically charged branding; focus communications on how actions improve operational resilience, customer trust, and market access.

- Greenwashing/Greenhushing safeguards: Tie all public disclosures to quantifiable Total Value metrics, avoiding overstated claims and ensuring consistency across filings, investor materials, and marketing.

Restoring Stakeholder Confidence

Total Value converts ESG aspirations into stakeholder contracts — commitments backed by transparent metrics that are meaningful to investors, clients, and regulators alike. For example, Spark Social’s Impact Pass methodology can translate social and environmental initiatives into “Impact Dollars” that quantify contribution alongside financial return.

Customization for Jurisdictional Conflicts

The Total Value framework allows financial institutions to:

- Offer products tailored for different legal regimes without undermining firm-wide commitments.

- Use modular reporting where core Total Value KPIs remain constant, while jurisdiction-specific disclosures adapt to local requirements.

The Path Forward: ESG Evolved into TVI (Total Value Integration)

The ESG debate has become a zero-sum political fight. The Total Value model offers a way to evolve beyond it — aligning business growth, stakeholder trust, and societal benefit into one performance architecture.

Action Steps for Financial Institutions:

- Audit — Map current ESG activities against Total Value categories to identify tangible value contributions.

- Translate — Convert non-financial initiatives into financial and operational performance language.

- Standardize — Adopt Total Value KPIs to unify internal reporting, investor communications, and regulatory disclosures.

- Customize — Adapt messaging and compliance approaches to each jurisdiction while maintaining a consistent value narrative.

- Educate — Train internal teams to articulate Total Value benefits to clients, regulators, and policymakers.

Conclusion

ESG in its current form has become both a political flashpoint and a business risk. But the principles behind it — risk mitigation, innovation, long-term resilience — remain essential. By reframing ESG into the Total Value model, financial institutions (and other companies) can replace ideology with integrated value creation, navigating legal challenges while building a future-ready business.

You may also like